How to Bid on Rigly Auctions

Nico answers the top 2 questions we hear at Rigly.

Rigly is a hashrate marketplace where miners sell their hashrate to bitcoiners who want to participate in mining. The inevitable questions:

- How much does it cost?

- How much can I make?

To answer the first question, we let the market decide how much the hashrate should go for by selling it at auction. In this sense, Rigly is like Ebay:

- You pick an auction

- Place a bid

- Others place bids- and the winner takes the hashrate

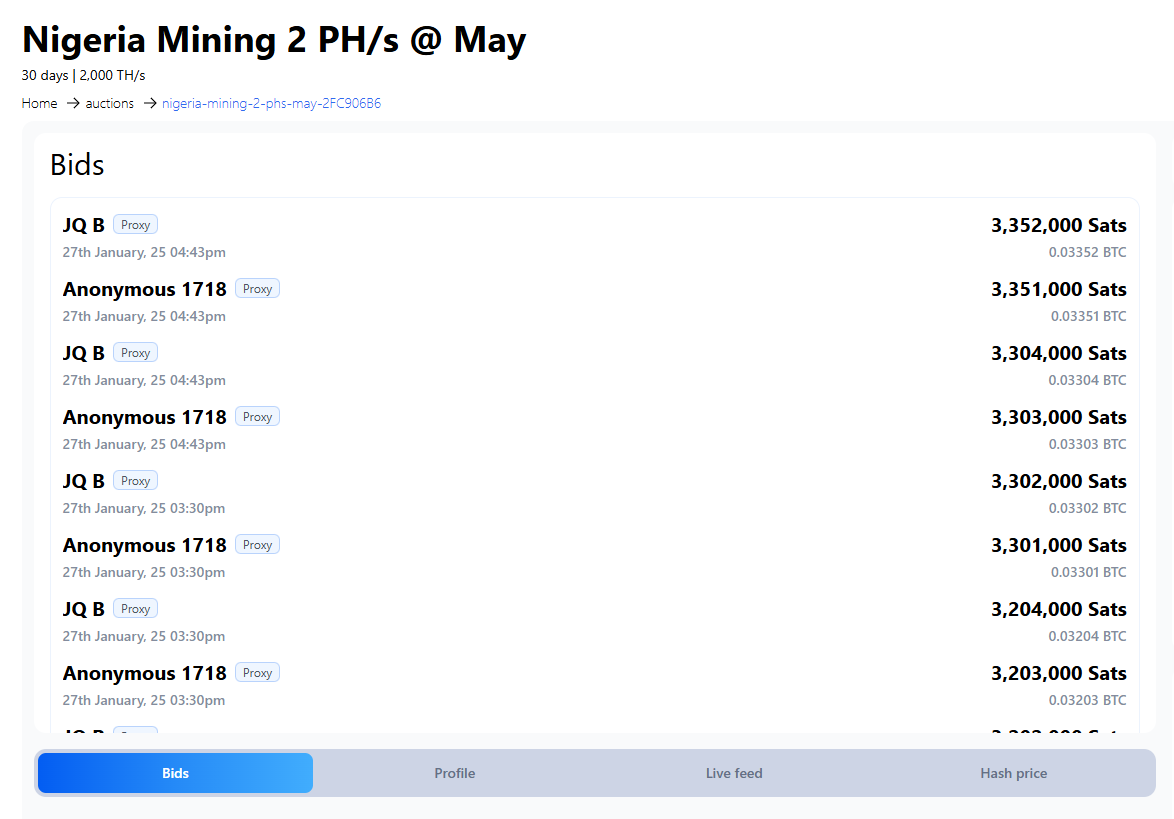

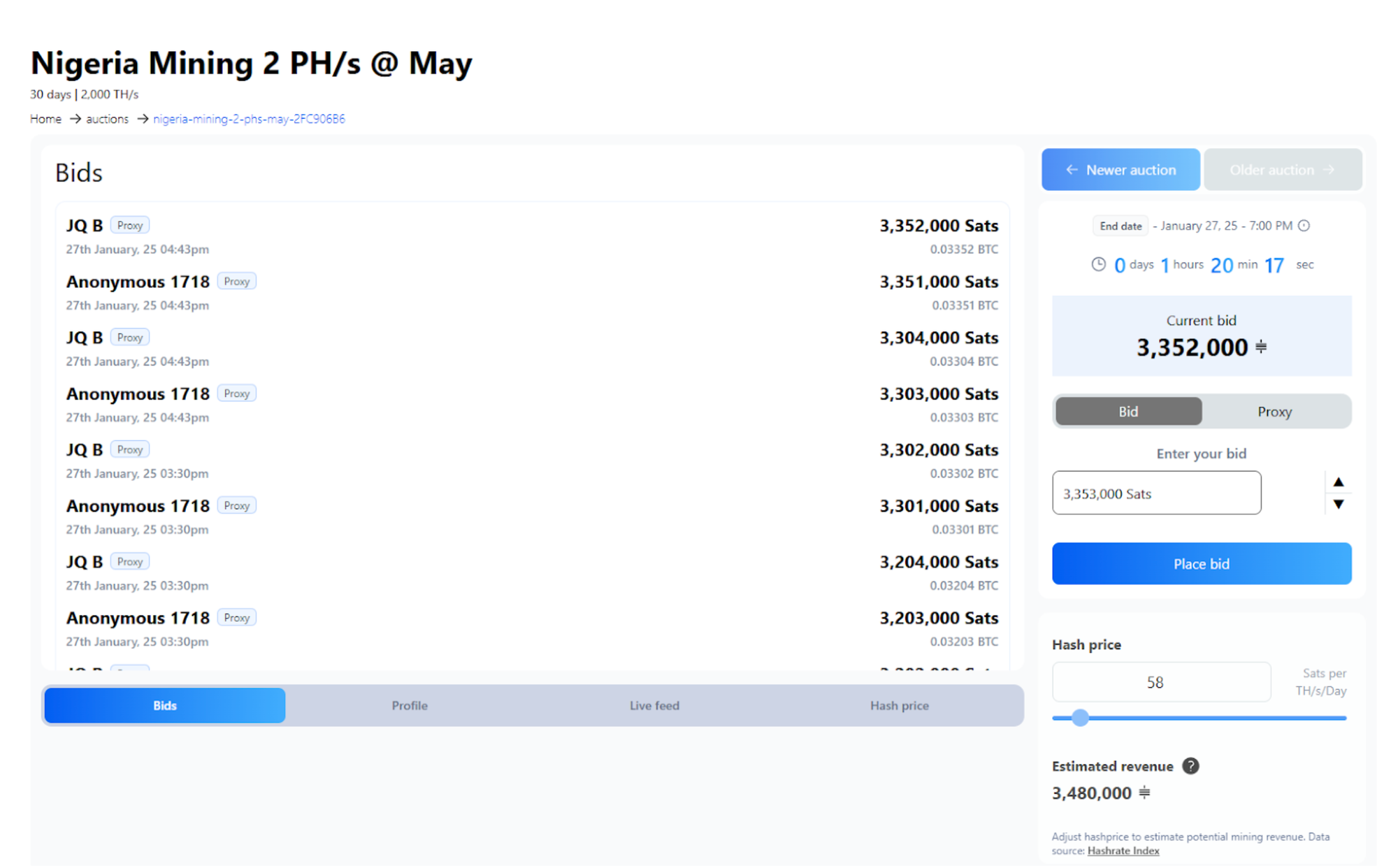

In the auction above, you are bidding to receive 2,000 TH/s (2 PH/s) for the month of May from a seller in Nigeria:

- You see the list of bids that have been placed

- Below that, we have a toolbar where you can get more information on the auction

I’ll go over these first, then we’ll get back to bidding.

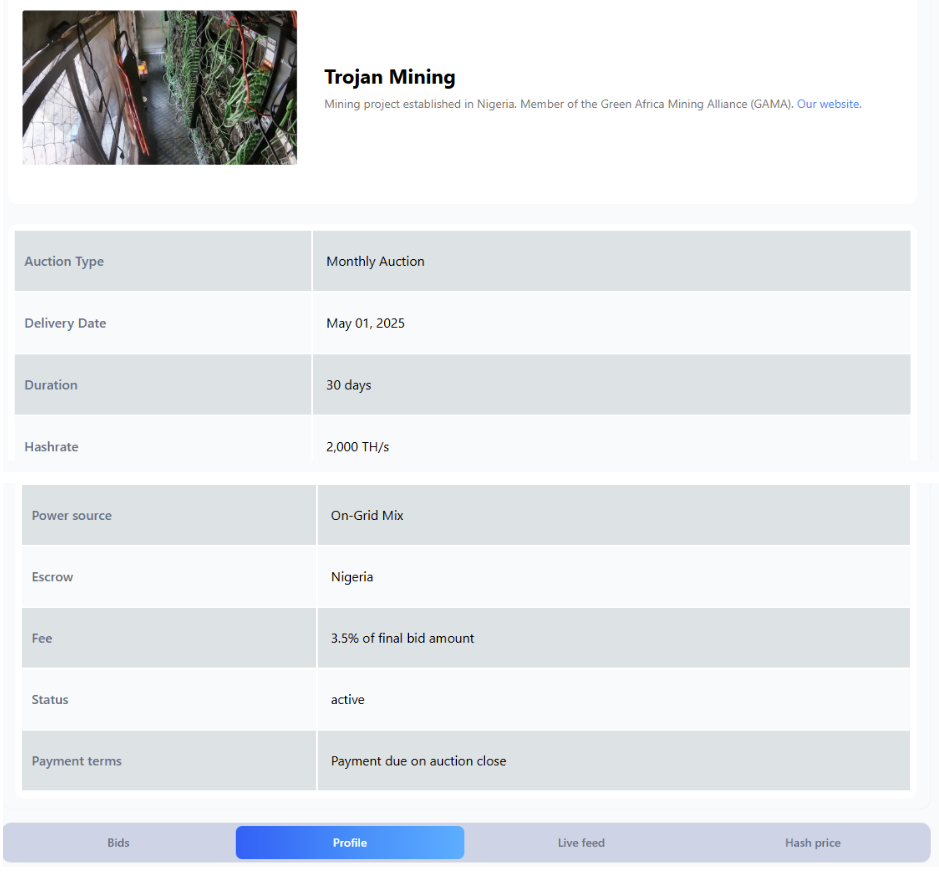

In the Profile section you see details about the seller, the power source, and payment terms. Next to the Profile tab, you’ll see the Live Feed of the hashrate currently being routed over our Stratum proxy server.

Rigly works by taking in hashrate from a seller through what’s called a Stratum proxy server. The Rigly Stratum proxy works much like a post office relaying mail or an old-school telephone switchboard, but instead of relaying post or phone calls we relay Stratum messages.

- Stratum is the name of the protocol that most bitcoin miners and pools use to coordinate work amongst many participants across the network.

- In this tab, you see the live feed of our proxy server where the hashrate from the seller is currently pointed.

Now you may ask yourself Why does the graph go up and down instead of stay flat? This is called variance, and it is a product of how mining works; it’s probabilistic: in any given second, you may record more or less hashrate. I’ll go into hashrate variance in more detail in another post.

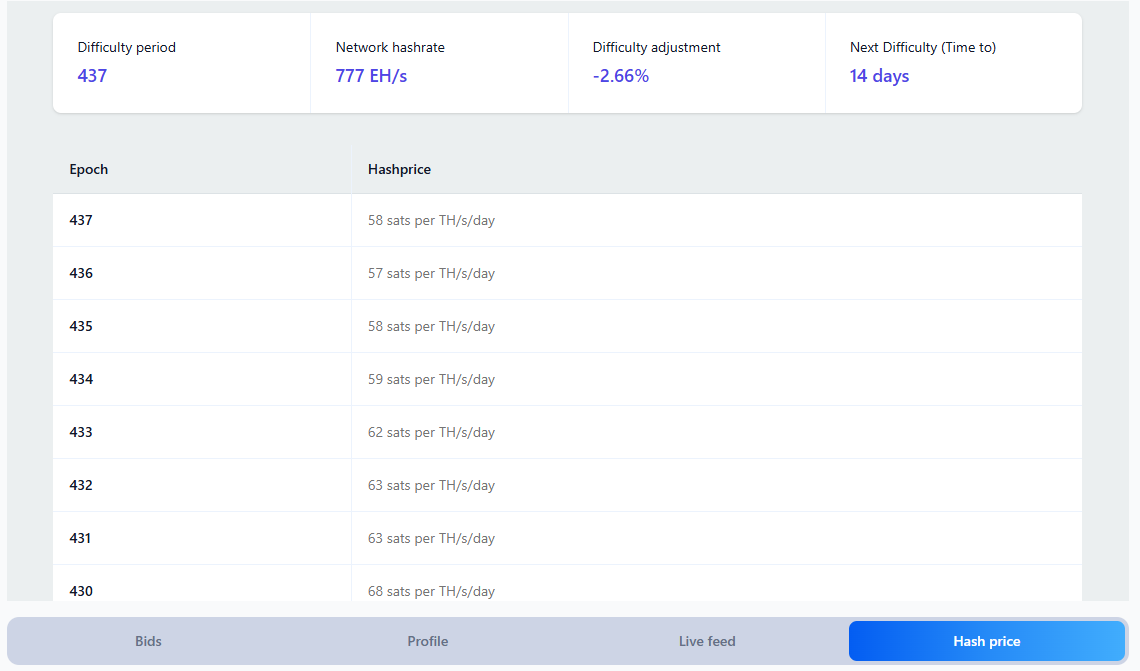

Now finally we have the Hash Price tab; this is where you should go for information on what hashrate is worth today (this tab takes a few seconds to load because of the API calls; we’ll get that sorted soon™).

Here we get into the weeds of mining economics:

- At the top left you see the Difficulty period. Bitcoin adjusts its “mining difficulty” every 2016 blocks, which if block times are coming out at 10 minute intervals is about two weeks. The more hashrate that is trying to find new blocks at a given difficulty, the faster blocks come out, and you will see that the difficulty period lasts less than two weeks because blocks are being found on average faster than every 600 seconds (10 mins).

- Satoshi designed bitcoin for nodes to adjust the difficulty of finding what they consider a “valid” block, so that new valid blocks are always found on average every ten minutes.

- This mechanism is called the difficulty adjustment and works by making it slightly more or less likely to find a target hash that is considered valid by the nodes on the network. Again, I’ll get into this more in a separate post.

For now, what you need to know is that the network difficulty corresponds to the amount of hashrate on the network and thus how many mouths there are to feed, so to speak.

Because the amount of new bitcoin that is emitted is the same, the more mouths the smaller each ration and vice versa. The only caveat here is that transaction fees are not fixed so when fees go up there is more bitcoin to go around for miners.

In the Hash Price tab, we see that the next difficulty adjustment is expected to go down 2%, but to the right of that you see that we’re still 14 days away, which means we just had a difficulty adjustment and that it’s likely not a great indicator yet of what the next adjustment is going to be. This is because there’s very little data to go on. The closer you get to the next adjustment the more certain of what that change will actually be.

Now, finally, below you have the list of recent difficulty epochs with their respective hashprices. This is the value in sats per unit of computation, usually measured in Terahashes per second or TH/s (Tera is a trillion or 10^12, fyi).

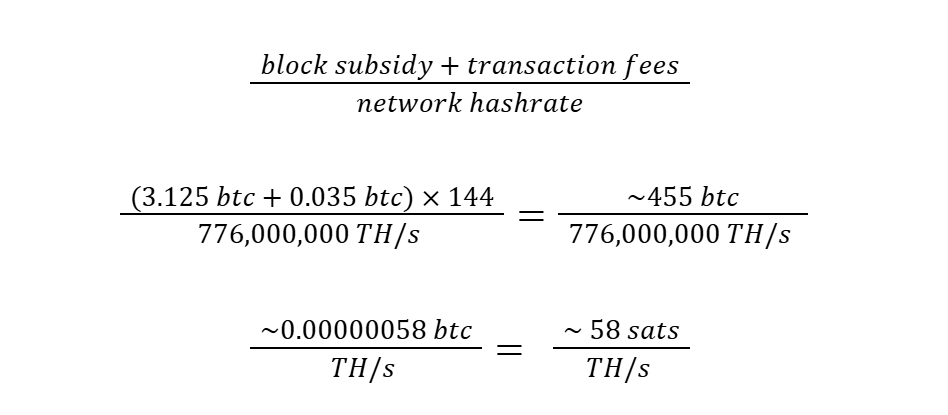

Hashrate is widely priced today by mining pools that have to calculate how much to pay out each of the workers in their pools. Most mining pools use what’s called the FPPS rate, which stands for Full Pay Per Share. The formula for this price is pretty straightforward: first, take the bitcoin block subsidy (currently 3.125 btc per block) and add the transaction fees, then multiply this by 144 for the amount of blocks on average per day and then divide by the total amount of hashrate currently working to find the next block.

The careful observer will note we’re glossing over how you calculate and add in the transaction fees, but for the sake of simplicity we’ll skip over that for now.

Ok cool, so now we know what the value of that hashrate is under today’s conditions if it were sold to a pool using the FPPS pricing method, but what does that mean for you who are looking to bid on some hashrate at auction?

You have a few options:

- You can solo mine, i.e. point it to your own node or a solo mining pool– check out Evan’s block parties at upendo.rigly.io– which is basically a lottery.

- You could mine some testnet bitcoin, #ferdaDevs.

- You can point it to any one of a multitude of mining pools.

Most people choose option 3 because the pool will issue you rewards for the hashrate. The amount of rewards that you receive is related to the hash price equation above multiplied by the duration and speed of hashrate.

This gets us back to bidding on hashrate auctions.

What do we see?

- Rigly user JQ B has the current top bid for 3,352,000 sats

- To the right, you see there’s only an hour and twenty minutes left on the auction

- So, should you put in a higher bid?!

Below you see there’s two ways to set a bid:

- The normal “bid” set by default

- and the “Proxy” option

A proxy bid simply allows you to set a max bid, while only placing the minimum amount required to outbid any bids others place that is below your max bid. A proxy bid allows you to figure out a point up to which you’re willing to bid, set it and leave it knowing that it will outbid others up to your max bid threshold.

Below the Bid / Proxy option, you’ll see the bid amount field and the "Place bid" button, where you pull the trigger!

But before you do so let’s apply what we’ve learned here.

Below the Place Bid button you have some useful information to consider:

- The Hash price slider shows you the current FPPS hashprice, but remember that the hashrate you’re currently bidding on in this auction will be delivered in May, that’s three months into the future!

It is anyone’s guess what the Hashprice will be in roughly 6 difficulty adjustments, or what transaction fees will look like for that matter, but on average miners tend to calculate that difficulty increases at around 2-3% on average per difficulty adjustment.

That’s a 2-3% depreciation on average, roughly every 2 weeks. Again, this is excluding transaction fees. Nevertheless, if I were bidding on this auction, I would slide that hash price calculator to the left at least 12% which is about 7 sats. So my guess for the hashprice in May would be 51 sats.

Now the final step here is to plug everything into the revenue equation above, I multiply the hashrate speed (2000 TH/s) by the number of days I would receive that hashrate (30 days) and by the hashprice (51 sats/TH/s/day), which we’ve done for you with Estimated Revenue.

If we adjust the Hashprice slider to my 51 sats guess, doing so drops the projected revenue from 3,480,000 sats to 3,060,000 sats. If that projection were to be correct, I would make 350,000 sats less back than I put in by trying to beat the current highest bid. DYOR.