Rigly Saturday Update

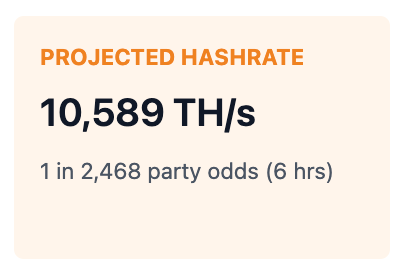

More PH/s of Canadian hashrate available for fixed return mining available, plus our Saturday block party coming up next week.

New mining available

We added more fixed-return hash from Wild Rose mining farm in Alberta, Canada. Buy now for Monday turn-up.

Fixed return mining

5 lots of 500 TH/s each available at 6% discount to daily FPPS hashprice at 180 day duration.

How much can I earn with fixed-return?

- You can use Wilson Mining with their very-low fee FPPS pool (just 0.38% fee) and earn 4.62% return in 180 days with the Wild Rose hashrate

- You can YOLO it with Ocean Mining and earn a variable return, based on how many blocks the pool mines over your mining term

- Or use any bitcoin mining pool - see our list and compare fees and payout format

The choice is yours.

Block party is next week

Join us as we solo mine together. We're trying for a block worth $350,000+

Join our Telegram Group

We're talking all things mining.

What we're reading

Hashrate is like the rate that miners pick numbers out of a hat \ stacker news ~bitcoin_beginners

Finding a bitcoin block is like picking a number out of a hat. A hash is like reaching in the hat and picking out a single number. All miners on the network are reaching in the hat over and over, as fast as they can, hoping to pick out the right number. When a miner picks out the right number, observers of the network, like us, can only see that the miner holds the right number. We cannot see how many reaches the miner made into the hat in order to find the right number. Sometimes miners get luckier than expected, pulling the right number out of the hat after only a few reaches. Sometimes miners make as many reaches as we’d expect (or more) before pulling out the right number. It could’ve taken the miner one reach, two, or far more than a trillion trillion reaches. We, the network, only know that the miner holds the right number and how long it took them to pull it out of the hat. The bitcoin network is designed so that it takes miners, on average, 10 minutes to pull the right number out of a hat after a new hat is introduced. If for most recent hats miners pulled the right numbers out faster than expected, that probably means bitcoin miners made more reaches into the hat per second than expected. That is, miners probably increased their reachrate. We say probably increased their reachrate, because it’s possible miners didn’t increase their reachrate at all. Miners might just be on a lucky streak. Lucky streaks don’t last forever though, and the longer a lucky streak lasts, the more likely it is that miners have really increased their reachrate. So we can never with 100% confidence say what the hashrate, or reachrate in our metaphor, is. We can only observe how fast miners are finding blocks and make informed guesses about the network’s hashrate based on that. The longer we observe miners doing anything though, the better our guesses about miners get. The longer we observe miners finding blocks faster or slower, the more confident we can be that the hashrate has probably increased or decreased. [9 comments]

Bitcoin Mining ‘Incredibly Difficult’ as Power Becomes the Real Edge \ stacker news ~bitcoin_Mining

I found this an accessible article about the current state of large miners. Most of them see themselves as high-power datacenter companies that don’t care whether they’re hosting GPUs or ASICs. And at least while AI is frothy, they stand to make more money. To stay profitable most miners need power costs taking up 50% of revenue or less: “Bitcoin mining is an incredibly difficult business,” he said. He broke down the economics of bitcoin mining in straightforward terms: with electricity priced at five cents per kilowatt hour, it currently costs around $60,000 to mine a single bitcoin. At a bitcoin price of $115,000, that means half the revenue is consumed by power alone. Once corporate expenses and other operating costs are factored in, the margins tighten quickly. In his view, profitability in mining hinges almost entirely on securing ultra-low-cost power. While most miners sit at around 50%, Iren claims that power costs eat only 25% of their revenue: ren, according to him, is currently operating at 50 exahash, which translates to a billion-dollar annual revenue run rate under current bitcoin market conditions. He noted that the company’s gross margins — revenue minus electricity costs — stand at 75%, and even after accounting for corporate overhead and SG&A expenses, IREN maintains a 65% EBITDA margin, or roughly $650 million in annualized earnings. Producing the miners themselves gives Bitmain a strong competitive advantage (and keeps the difficulty growing regardless of whether other miners are expanding): He pointed to Bitmain, which continues to produce mining rigs regardless of market demand, thanks to its direct pipeline to chipmakers like TSMC. Even when miners aren’t buying, the company can deploy the machines itself in regions with ultra-cheap electricity — from the U.S. to Pakistan — flooding the network with hash power and driving up mining difficulty. That global footprint, coupled with low production costs, allows Bitmain to remain profitable while squeezing margins for everyone else. Cleanspark’s CEO thinks the four year cycle is dead: “The four-year cycle is effectively broken with the maturation of bitcoin as a strategic asset, with the ETF and now the strategic treasury and whatnot,” Schultz said. “The adoption is driving demand. If you read anything about the most recent ETF, they’ve consumed infinitely more bitcoin than have been generated so far this year.” Meanwhile, Marathon’s CEO disagrees: “This reminds me of those trends in commodity-exposed cycle industries,” Khan said. “There are some very wealthy families in the oil sector who made billions, and then there are others who have filed bankruptcies. You have to have a strong balance sheet to survive these cycles.”

The Avant-Garde And Bitcoin: Decentralized Money Didn’t Come From Nowhere

Bitcoin did not emerge in isolation. Its logic — consensus over authority, rules over rulers, time as structure — belongs to a century of experiments once carried out in the avant-garde. Bitcoin wasn’t an accident of code but a century-long attempt to imagine systems beyond authority.

Happy Saturday,

Team Rigly