The Challenges of Bitcoin Mining

Adventures in Mining Decentralization

This post is based on a presentation that the Rigly team gave at BTC Prague, where we were finalists in their start-up pitch contest.

If you'd like to watch the presentation and listen to the Q&A, you can see it here on YouTube – or see us at Bitcoin 2024 pitch contest in Nashville!

Evan's Adventure in Mining

In 2021, I was part of a proof-of-concept project to use bitcoin mining to help fund solar energy infrastructure in Africa. This was my first attempt at bitcoin mining.

I quickly learned that finding where to buy the ASIC mining rigs was not straightforward, and shipping, customs and logistics were a massive challenge:

- Out of a dozen rigs we shipped to Zimbabwe, only one (!) made it online.

- After just three days, our site contact complained that the mining rig was too loud– and turned it off.

But I wasn't ready to give up. While this project didn't work out as planned, I saw hashrate hit my pool account and earn new sats– this was very exciting.

And so, for round 2, I bought a new ASIC rig from a small hosting company in Texas. It was live for just one day, then went offline with no notice.

It turned out that the company fried the thing on that first day. Mining rigs get very hot when they are running. And when you don't have proper cooling and are operating somewhere hot, like Texas... well, you get the picture.

This is when I learned the phrase Don’t trust, verify. But more to the point - I learned that mining is hard:

- Sourcing ASICs is expensive and challenging

- The logistical issues around transporting ASICs to a site

- Keeping ASICs operating (ideally using cheap electricity) requires careful maintenance and often trust in a 3rd party

As I learned, It's in that 3rd bullet point - trust in a 3rd party - where people usually get rugged and give up.

Centralization Issues

Why should you care? Why not just leave mining to someone else?

Well, due to these barriers to entry, behemoths like Bitmain have been able to swoop in and take control of the mining market:

- They control hardware manufacture (Antminer)

- They build and operate huge mining sites across the world

- They even own block production through the largest pool (Antpool)

Money in mining flows toward the manufacturer, making it easy for them to consolidate. This leads all the way down to the pools, where the biggest players can have the final say over which transactions actually get into blocks.

This graph illustrates the last point. Mononaut traced the coinbase transactions from the pools highlighted in purple and saw that all of these transactions were going to addresses controlled by one entity. The data indicates that all of the highlighted pools are proxies for AntPool.

There are three significant risks with this type of centralization:

- Transaction censorship - Regulators could make one phone call to a pool and apply pressure to start blacklisting transactions

- Double spend - A miner with 51% can double-spend their own funds

- Protocol changes - As we saw with Segwit, certain players can block protocol changes

Over time, mining will continue to centralize by default. And so Bitcoiners are at a crossroads:

- Stand on the sidelines and do nothing

- Fight to decentralize mining?

The answer is obvious. We need to solve mining centralization, but how?

Enter Rigly.

Rigly: A Decentralized Solution

Rigly is a marketplace that sources hashrate from mining farms around the world.

- We take hashrate from large mining farms that would have been pointed at one pool and distribute it across multiple buyers (and various pools)

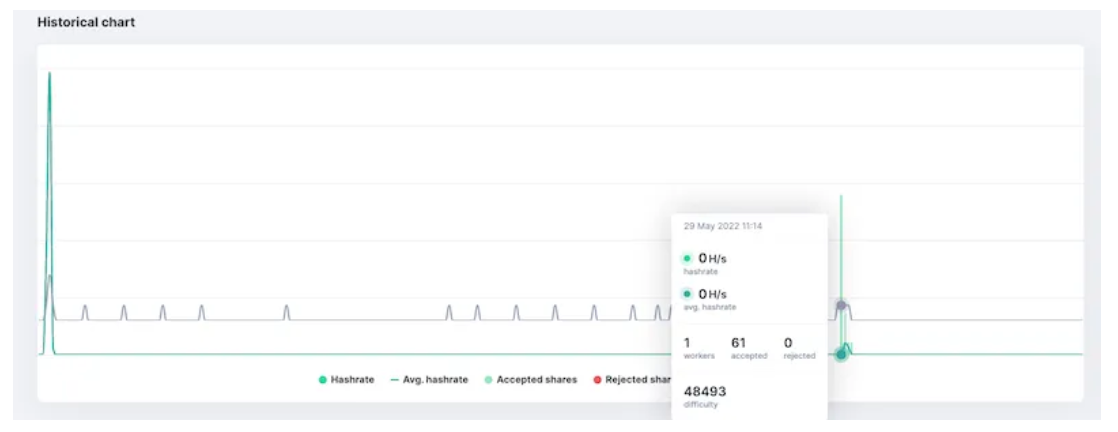

- The hashrate is routed over our stratum proxy directly to the mining pool account of your choice

- There’s always some downtime in mining, so we use bitcoin’s multisig as an on-chain escrow to secure your payment

The Economics of Decentralized Mining

In order for miners to point their hashrate elsewhere, they need to make more than they would have from mining to their own pool account.

Since hashrate is a limited resource, Rigly lets the market determine the price by selling it at auction.

What are the incentives for buyers and sellers?

Two words: time preference

Buyers are also hodlers. Since they have low time preference, they can afford to wait for the bitcoin price to go up. But they also don’t want to lose freedom and privacy.

Miners have high time preference because they need to pay their electricity bills, making them forced sellers of bitcoin for fiat. They want better margins to scale their operations.

Here we can trade time preferences:

- Mining farms earn more by selling hashrate to the highest bid

- Bitcoiners pay the premium for a more decentralized and higher-value network tomorrow

Bitcoiners pay to send hash to smaller pools, solo mine, push SV2 adoption, and earn anonymous bitcoin. Buyers trade KYC’d centralization for decentralized anonymity; they keep the network permissionless and censorship-resistant.

Taking Action for a Decentralized Future

In the Bitcoin whitepaper, Satoshi describes how proof-of-work “solves the problem of determining representation in majority decision making”. The idea was equality through one-CPU-one-vote.

However, with the advent of ASICs and giants like Bitmain, we have lost that equality. Restoring that equality means giving hashpower back to the people.

There are 106 million bitcoin holders. To decentralize 1% of the network, we only need 10,000 people to start mining with Rigly.

We’re not saying you should go spend your whole stack on hashrate, but a small allocation to decentralize the network will help the rest of your bitcoin hold its value and stay censorship-resistant.

Rigly at Bitcoin 2024

We're in Nashville this week!

Vote for us in the People's Choice award and come see us at the Pitch Contest on Thursday.