Understanding bitcoin network hashrate and hashprice

Before you bid on a Rigly mining auction, read this to learn about hashrate and hashprice.

Some things to know before you bid

Hello bitcoiner! Let's explore a few things about hashrate and hashprice before you bid on a Rigly mining auction.

What is hashrate?

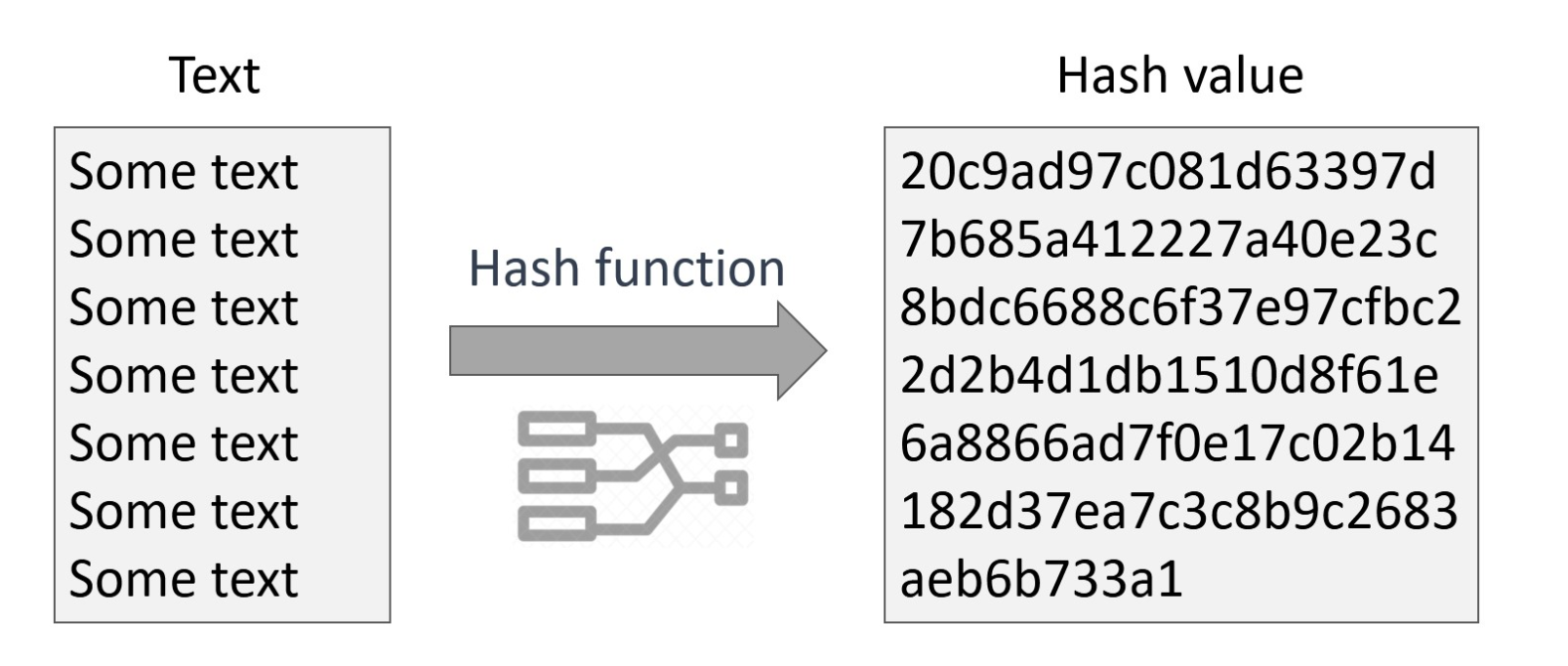

Before we talk about hashrate, we need to understand what a hash is:

Hash [noun] - mathematical function that converts an input of arbitrary length into an encrypted output of a fixed length

When a mining rig connects to a mining pool, it generates trillions of hashes in order to find the unique hash for the next transaction block in Bitcoin's blockchain. Hashrate is how we refer to the speed of hash generation:

Hashrate [noun] - unit of measurement for the amount of hashes per second generated by a bitcoin miner

Hashrate is commonly listed with the prefixes Tera, Peta and Exa

- TH/s: Terahash ... 1,000,000,000,000 hashes per second

- PH/s: Petahash ... 1,000,000,000,000,000 hashes per second

- EH/s: Exahash ... 1,000,000,000,000,000,000 hashes per second (!)

When you bid on a Rigly auction, you are bidding on mining rigs that generate hashrate.

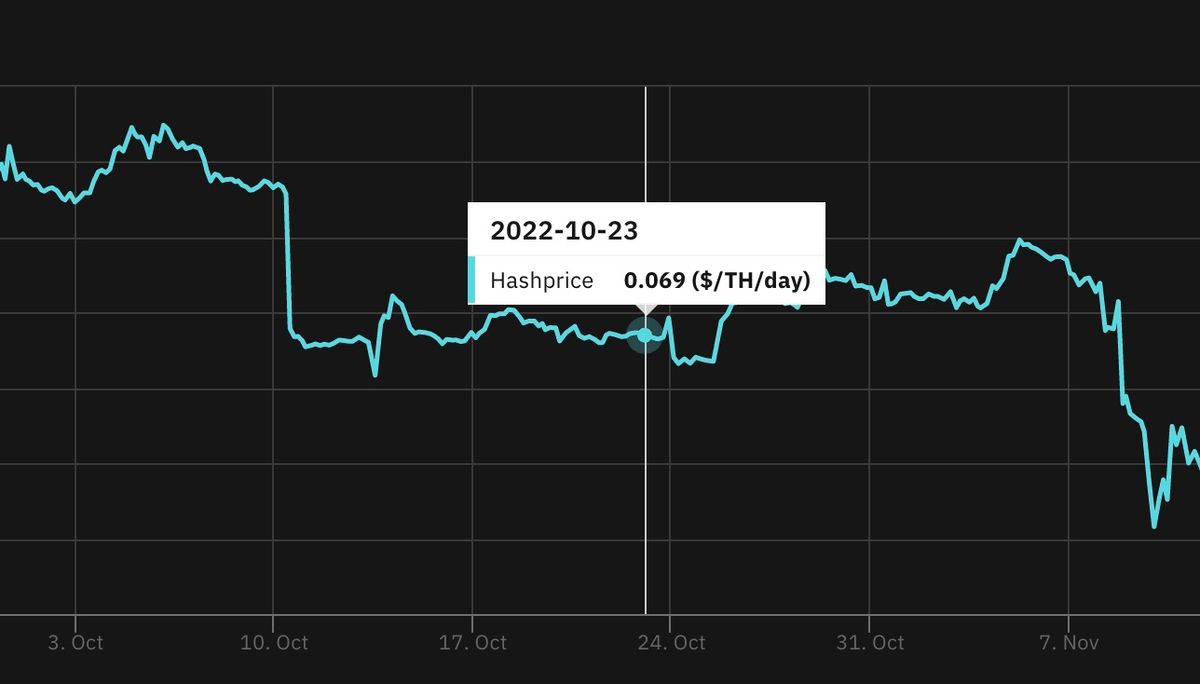

What is hashprice?

Hashprice is the potential revenue of a miner for a unit of hashrate. It is highly variable over time and calculated like so:

Hashprice = Block reward + Transaction fees / Network Hashrate

Let's consider an example:

(6.25 BTC * 144) + (6.25 BTC * 144 * 0.02) / 250,000,000 = 0.00000367 bitcoin per TH/s/day

This hashprice of 367 sats per TH/s/day is based on the following:

- 6.25 btc block reward

- 1 day of mining (assumes 6 blocks/hour, or 144/day)

- Estimated transaction fee value of 2% of block reward

- Total network hashrate of 250 EH/s

Hashprice is the measurement used in the mining industry to determine the market value per unit of hashing power. We refer to hashprice in bitcoin; however, you may see it referenced in fiat terms elsewhere.

How does hashprice change?

Several elements affect hashprice on different spans of time:

- Block reward

- Transaction fees

- Network hashrate & mining difficulty

The current block reward subsidy is 6.25 bitcoin. Every 4 years, this subsidy is cut in half in an event called the Halvening. After the next Halvening, likely to occur sometime in 2024, the block reward will go down to 3.125 bitcoin.

Transaction fees are currently a small part of the hashprice. However, when block space is at a premium and transaction fees are high, miners do see a modest increase in hashprice. For example, when one large exchange issued a batch of consolidation transactions at an unusually high fee rate, miners earned over 3% in fees.

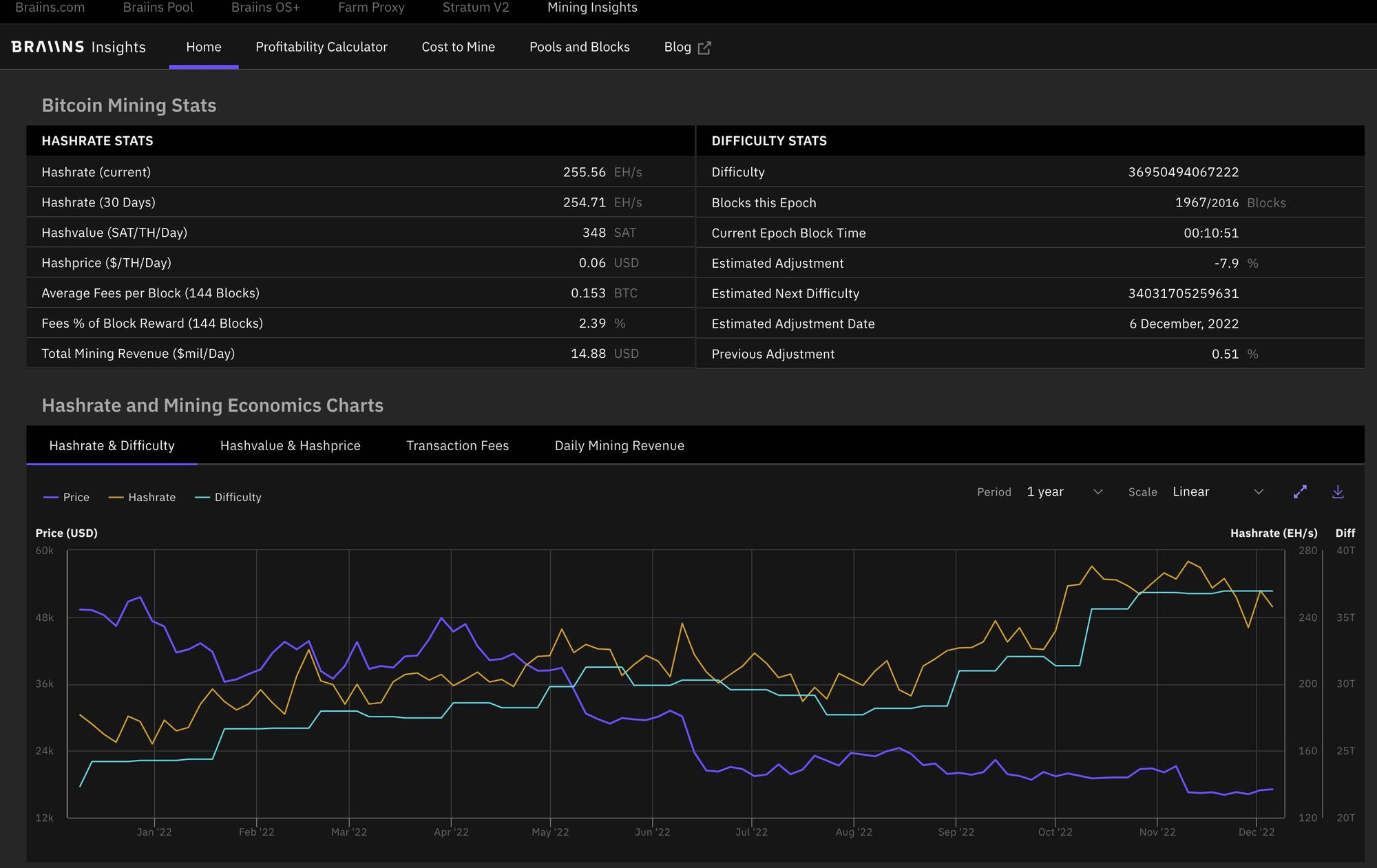

Global network hashrate and mining difficulty make the biggest impact on hashprice in the near term.

How network hashrate & difficulty impact the hashprice

Let's recall the hashprice calculation and our example:

Block reward + Transaction fees / Network Hashrate

Network hashrate at 100 EH/s:

(6.25 BTC * 144) + (6.25 BTC * 144 * 0.02) / 100,000,000 = 0.00000918 bitcoin per TH/s/day

Network hashrate at 300 EH/s:

(6.25 BTC * 144) + (6.25 BTC * 144 * 0.02) / 300,000,000 = 0.00000306 bitcoin per TH/s/day

In other words:

More network hashrate = less bitcoin per miner

However, it is important to note this is a simplified view into how network hashrate impacts the hashprice. This example assumes blocks are found every 10 minutes on average. This is rarely the case!

When blocks are found faster (or slower) than the 10 minute average, the difficulty adjustment in the bitcoin protocol acts to slow down (or speed up) the frequency of finding a block. The bitcoin protocol adjusts difficulty every 2,016 blocks. The goal of this adjustment is to make it so new blocks are found (on average) every 10 minutes.

For instance, let's consider the adjustment on October 10th:

- Between 9/27 and 10/10, new blocks were found an average of <9 minutes (!)

- This resulted in more daily revenue for miners, followed by a huge difficulty adjustment (+13.55%) on 10/10

- Bitcoin's difficulty adjustment slowed down average block discovery to 9 mins 40 seconds in the following weeks

Fun fact: each 2,016 block interval is called a mining difficulty epoch

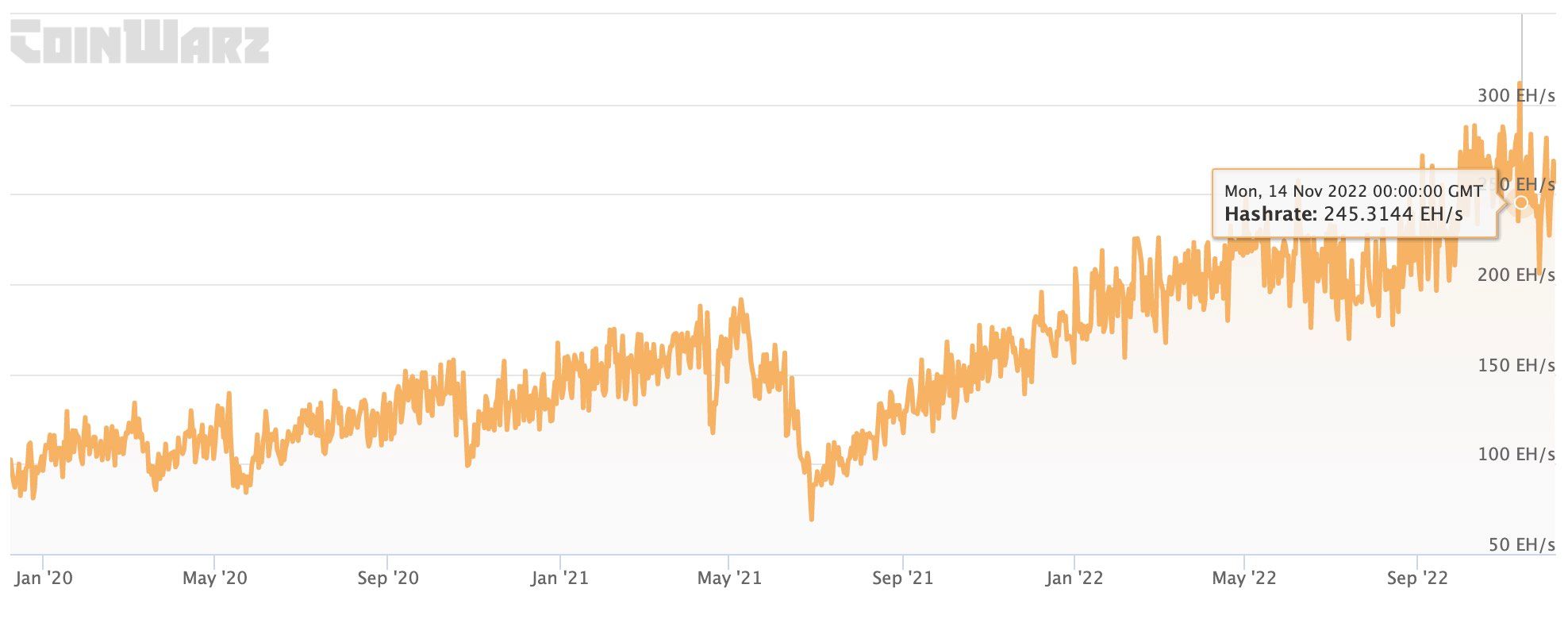

Where will bitcoin's network hashrate go?

The long term trend is up.

Along the way, many things that can impact bitcoin's total network hashrate:

When new mining rigs are added to the network

The total network hashrate goes up, blocks are found faster, bitcoin mining difficulty goes up and hashprice goes down.

When mining is prohibited in a region

The total network hashrate goes down, blocks are found slowly, bitcoin mining difficulty goes down and hashprice goes up.

When faster, newer mining rigs are introduced

The total network hashrate goes up, blocks are found faster, bitcoin mining difficulty goes up and hashprice goes down.

When older mining rigs are not profitable and turned off

The total network hashrate goes down, blocks are found slowly, bitcoin mining difficulty goes down and hashprice goes up.

Now that you understand hashrate and hashprice, you can make your own estimate of where it will go in the future. Good luck & do your own research!

Further reading

A Semi-Technical Dive into Bitcoin Mining - Ettore Murabito in The Capital (Medium)

Practical Cryptography for Developers - Svetlin Nakov

The Mathematics of Bitcoin: SHA-256 - Toby Chitty in The Startup (Medium)

What is a hash? Investopedia

What does hashrate mean and why does it matter? Coindesk

Other resources