Rigly Newsletter: March 2nd, 2024

The latest news, plus reflections on mining, KYC and privacy and more.

Welcome to epoch 413. Bitcoin network difficulty adjusted down -2.90% and is now 79.35 trillion as of a few days ago.

We are now less than 50 days away from the Halvening.

Story time

Hey there, it's Evan. When I started Rigly in 2022, my goal was to offer a way to mine Bitcoin without the need to buy an ASIC mining rig, thus avoiding the risk of a mining rug pull.

The first version of the website introduced many people to mining:

As it turns out, I wasn't the first person to have this idea. There are two other hashrate marketplaces. This one is easy to find and the other requires some digging. Both of these marketplaces connect you with miners who sell their hashrate over the spot hashprice.

This struck me as odd.

Who would trade their hard-earned bitcoin .... for hashrate which earns less bitcoin?

Let's talk about privacy

My first thought was this must just be money laundering. Because, like, why else would someone trade money for less money? And then I did my own research and learned about KYC (Know Your Customer).

You see, whenever you buy bitcoin, you must verify yourself with the same level of identification as opening a bank account. This has been the norm for years, and I never thought much of it, and if you are treat your bitcoin like a balance in a bank - and trust your exchange - then maybe all of this is no big deal.

However, exchanges are not banks. They are not insured by the FDIC and there are many cases where customers have lost their entire balance. As a result many folks self-custody their bitcoin. There are many other reasons people do this, since self-custody is a key feature of bitcoin.

Which brings us back to the question: Why buy hashrate? Would you feel comfortable knowing that your personal information—your photo, driver's license, and physical address—is stored indefinitely in a database and tied to your bitcoin address, which is on the public blockchain?

If this makes you uncomfortable - and it should - then maybe it's time to take action.

Take back your privacy

I realized, after considering the numerous exchange hacks and connecting the dots, that large amounts of personal information were only as private as their weakest link. The data linking personal information to Bitcoin is stored in your exchange's database, even if you opt for self-custody.

While many people trust their exchanges to keep their data safe, others buy hashrate and mine new Bitcoin to break this link and take back control of their financial privacy.

Break the link with Rigly

The path to financial privacy is embedded in the bitcoin protocol. You don't need to use a mixer and risk mingling your hard-earned bitcoin with illicit actors. All you need to do is

- buy hashrate

- send to your mining pool account

- earn new bitcoin

KYC and the legacy system is rigged to erode your privacy by linking your personal info with your bitcoin. Rigly fixes this by providing a way to buy hashrate at auction for a fair market price.

Introducing New Daily Auctions

We have heard your requests for more hashrate, and so next week we're running a daily auction for 1 PH/s @ 24 hours. Get excited because these auctions open at 20% below spot hashprice.

Network Data

Hashprice

- 171 sats/TH/s/day

Network Hashrate

- Network Hashrate: ~586 EH/s

Difficulty Adjustment

- Epoch 410 / January 20 -3.90%

- Epoch 411 / February 2 +7.33%

- Epoch 412 / February 15 +8.24%

- Epoch 413 / February 29 -2.90%

- Epoch 414 prediction at 79.42T (+0.09%) (Source: btc.com)

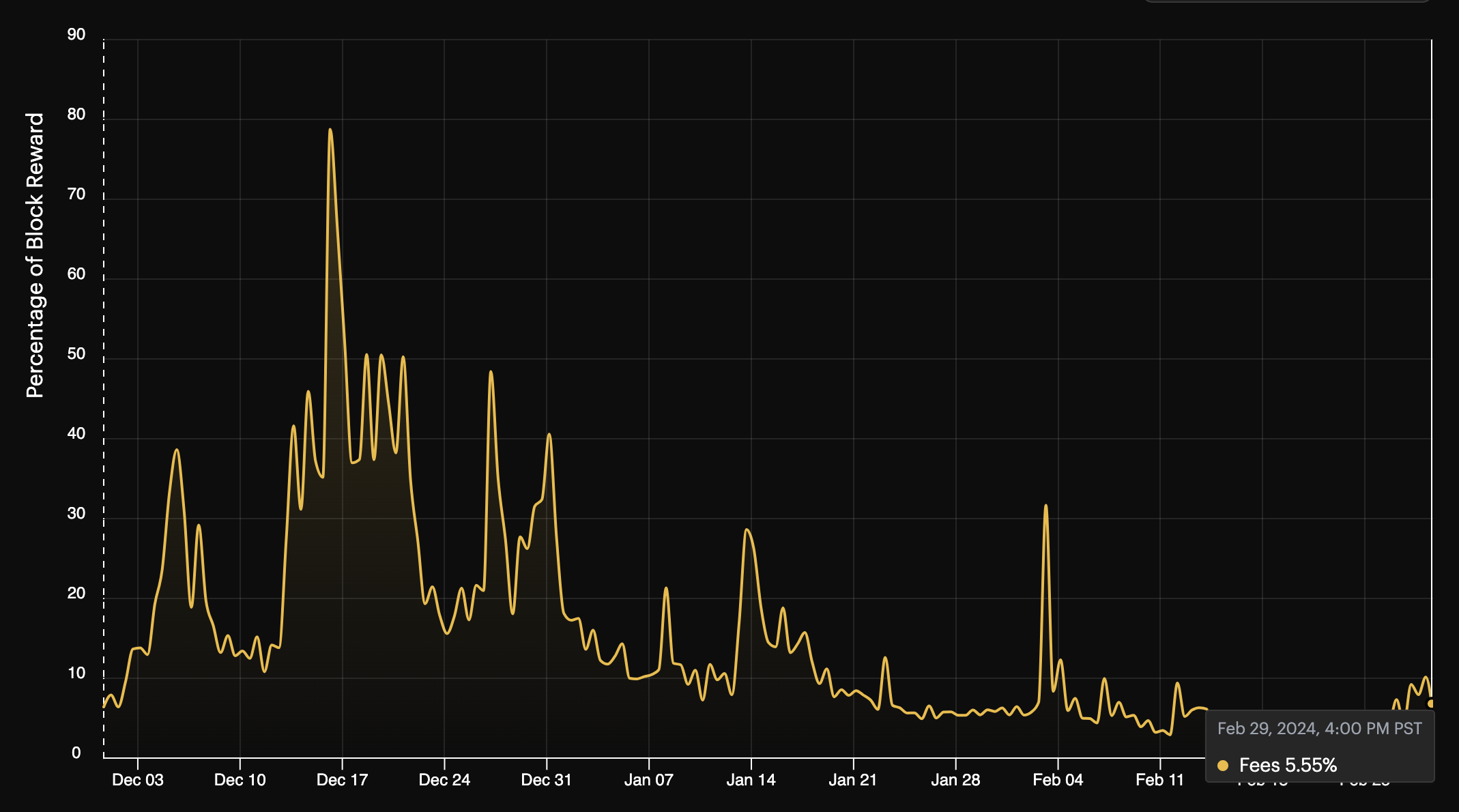

Transaction Fees

Transaction Fees: 5.55% of block reward

Start Mining for Just 500 sats

Are you still waiting to start your mining journey? Start mining now with our Test Drive for just 500 sats!

Worthwhile Reading

Happy Saturday!

Thanks for reading all the way,

Team Rigly