Rigly Newsletter: March 16th, 2024

The latest news, reflections on the "kyc-free" premium and privacy, and what we're reading this week.

Welcome to epoch 414. Bitcoin network difficulty adjusted up +5.79% and is now 83.95 trillion as of Wednesday.

We are now approximately 36 days from the Halving.

Let's talk about KYC and premiums

The most common way of acquiring bitcoin is through an exchange. However, exchanges are financially regulated entities and therefore must follow KYC (Know Your Customer) regulations. Whenever you buy bitcoin, you must verify yourself with the same level of identification as opening a bank account.

However, exchanges are not banks. They are not insured by the FDIC and there are many cases where customers have lost their entire balance. As a result many folks self-custody their bitcoin, which is a key feature of bitcoin.

Exchanges, the typical on-ramp into bitcoin, produce a privacy concern:

- When you withdraw funds from your exchange, your bitcoin address is associated with your personal information

- Your photo, driver's license, and physical address are stored in a database and linked to your bitcoin address

If this makes you uncomfortable, then consider the value of non-KYC bitcoin. No one will know if you used the bitcoin and no one will know how much you own.

In a free market, it is natural for market actors concerned with their privacy to place a higher value on non-KYC bitcoin over KYC bitcoin.

How much value do you place on your privacy?

This week's daily auctions

Next week we're running a daily auction for 1.5 PH/s @ 24 hours. Get excited because these auctions open at 20% below spot hashprice.

Network Data

Hashprice

- 155 sats/TH/s/day

Network Hashrate

- Network Hashrate: ~624 EH/s

Difficulty Adjustment

- Epoch 411 / February 2 +7.33%

- Epoch 412 / February 15 +8.24%

- Epoch 413 / February 29 -2.90%

- Epoch 414 / March 13 +5.79%

- Epoch 415 prediction at 83.90T (-0.06%) (Source: btc.com)

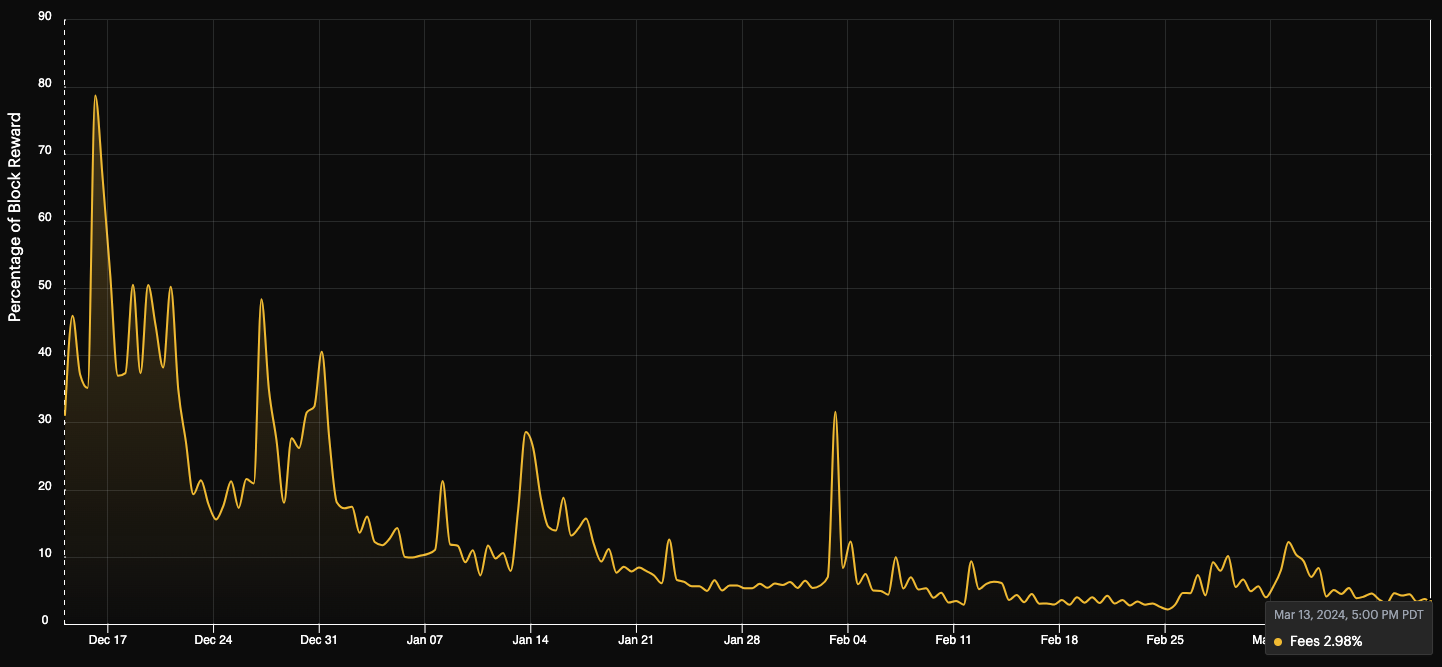

Transaction Fees

Transaction Fees: 2.98% of block reward

Start mining for just 500 sats

Are you still waiting to start your mining journey? Start mining now with our Test Drive for just 500 sats!

What we're reading

What would the world look like if everyone "mined their values" to balance the carbon footprint of their bitcoin stack?

More worthwhile reading

Happy Saturday!

Thanks for reading all the way,

Team Rigly